- On-Call News

- Posts

- More Doctors Fiscally Dragged into Higher Tax Brackets

More Doctors Fiscally Dragged into Higher Tax Brackets

Reeve’s budget will squeeze doctors, but will it improve the state of affairs in the UK?

Contents (reading time: 7 minutes)

More Doctors Fiscally Dragged into Higher Tax Brackets

Weekly Prescription

Does the NHS Benefit When Patients Go Private?

Board Round

Referrals

Weekly Poll

Stat Note

More Doctors Fiscally Dragged into Higher Tax Brackets

Reeve’s budget will squeeze doctors, but will it improve the state of affairs in the UK?

After months of speculation, the Budget is here. Okay, so perhaps between your nights, on-calls, and long days, it hasn’t been the first thing on your mind, but the annual budget is among the most politically and economically significant events of the year. So what does it actually mean for doctors?

Before Rachel Reeves even reached the dispatch box, the Office for Budget Responsibility managed to steal the show by leaking the entire budget. Cameras caught the Chancellor scrolling furiously on her phone like the SHO rapidly reviewing the steps to an arterial line before they reach the bedside.

That irritation spilt into her speech, with digs at Zak Polanski’s interesting pre-political career as a breast-enlarging hypnotherapist and the Reform party’s alleged Russian links. Once the theatrics settled, we finally reached some policies… let’s have a look at them.

The Big Collector

Reeves’ priority was rebuilding fiscal headroom, which is now estimated at around £22bn. Bound by Labour’s manifesto promise of “no tax rises for working people,” she avoided explicit income tax increases and instead deployed a more subtle but financially powerful lever, freezing income tax thresholds, now extended from 2028 to 2031. According to the OBR, this freeze is expected to raise an additional £8.3 billion in 2029/30.

Doctors are already painfully familiar with fiscal drag: wages rise (often only in line with inflation), but static tax thresholds nudge more earners into higher tax bands. For a workforce relying heavily on overtime, enhanced rates, and additional sessions, the effect is amplified and leads to… working people paying more tax.

By 2030, nearly 18% of working-age adults will be higher-rate taxpayers, which, in reality, means virtually all doctors, as even F1 doctors will join the higher-rate party.

This means that higher-rate taxpayers will pay an average of £1307 extra in income tax every year, and our high-earning senior registrars and consultants in the additional rate bracket will pay an average of £1958 extra in income tax annually.

(Cash) ISA ISA Baby

For doctors saving toward short-term goals (classically defined as under 5 years), such as house deposits, cars, and holidays, Cash ISAs are typically the safest, simplest, and most tax-efficient tool.

The Chancellor has now cut the annual Cash ISA allowance from £20,000 to £12,000. The rationale is that too many people (especially young people) “over-save and under-invest,” and reducing Cash ISA capacity will push them toward investing (especially in UK companies).

A commendable idea in theory, but will it hold up in practice? Cash ISA use has grown more than 200% faster than Stocks & Shares ISAs, and expecting inexperienced savers to “just start investing” without education, time, or support is optimistic at best.

For doctors, especially trainees, juggling financial uncertainty, short-term security often matters more than market exposure. This reduction does not apply to the over-65 age group, however, who have a shorter financial time horizon ahead and may need the stability of cash to offset market downturns.

Labour’s ‘Wealth Tax’

Growing pressure from economists such as Gary Stevenson and politicians like Zak Polanski to shift the tax burden away from income and more towards wealth led to Labour’s response of a ‘Mansion Tax’ starting in 2028. This will be a £2500 annual charge on properties valued over £2 million and a £7500 annual charge on properties over £5 million. The OBR estimates that this will raise around £400 million once behavioural change is accounted for. We wonder how many homes will be re-valued on Rightmove for £1.99 million?

For most doctors, this will be irrelevant. A minority of senior consultants, especially in high-cost areas (London, South East), may feel the pinch and have to ensure they free up some extra cash in their financial planning.

This is where On-Call is going to risk ruffling some feathers: we welcome the shift toward taxing wealth rather than labour. Our view is that income in the UK, particularly for those earning between the higher-rate and additional-rate bands, where many doctors sit, is already taxed significantly.

International comparisons support this. OECD data show that the UK taxes high earners at levels comparable to countries like Denmark and Norway. However, overall tax levels in the UK appear lower largely because lower-income households are taxed far less than their counterparts in the Nordic countries. This led the Financial Times to call the UK’s taxation system one of the most progressive among developed economies: a relatively small group of higher earners contributes a disproportionately large share of total tax revenue.

Doctors, especially consultants, registrars, and other senior trainees, already contribute significantly to this burden. Whether lower-income workers should pay more tax is ultimately a political question: it depends on what kind of public services, welfare state, and societal model the country wants. But in our view, relying almost entirely on income taxation has limits — push it too far and you risk disincentivising work, progression, and additional shifts.

A modest shift toward taxing accumulated wealth, rather than squeezing income further, may therefore represent a fairer and more economically sustainable direction. Some may worry for the asset-rich, cash-poor homeowners who likely don’t represent the majority of people living in £3 million homes. These individuals may have to downsize to offset these costs, which is a perfectly reasonable state of affairs in the opinion of many people in the country who weren’t fortunate enough to buy property in lucky pockets of the country that saw prices surge at exponential rates.

Some Other Changes

GP partners will not be required to pay employer national insurance on profits, ending an anxiety-inducing rumour that didn’t materialise, and prescription charges in England will be frozen for 2026-27, keeping the cost at £9.90. Those with dividend income (from stocks, side businesses, etc) will also see increased rates of tax rates.

Del Boy to Diagnosis: Cultural Fluency in the NHS

“Doc, I’ve been feelin’ proper cream-crackered lately. Look at me… I’m more washed out than a five-quid shirt from Peckham Market and every time I eat my Barnet Fair starts tinglin”

You glance down at your notes, wondering how to politely decode whatever that was. Maybe the Cockney/Del Boy impression is extreme, but it captures something every UK doctor knows too well: dialect, culture and communication shape half the consultation before the medicine even begins. These dialectical differences can even catch doctors who have lived in the UK for many years off guard, but especially tend to sting our international colleagues.

Evidence shows that general practitioners often find cross-cultural consultations significantly more stressful, and poor cultural competence is linked to real risks. The GMC tells us that up to 93% of our communication comes from our posture, tone and gestures and misreading those cues as a result of cultural divides can lead to pretty unfortunate consequences.

We rarely think in these terms, but often one misplaced gesture or inappropriate remark can entirely derail the emotional tone of a history, especially when handling challenging scenarios such as sexual histories, safeguarding discussions or breaking bad news.

Human Factors in Healthcare

Launch Offer: Enrol for £100 (usually £195)

Human factors sit at the heart of patient safety. Most serious incidents don’t happen because of a lack of medical knowledge – they happen when communication, teamwork, decision-making or systems break down.

Medset’s Human Factors in Healthcare course gives you practical and effective tools you can use immediately in everyday clinical work, as well as in leadership, management and teamworking roles. It covers:

Situational Awareness and Decision-Making

Advanced Communication and Teamwork

Managing Risk, Error and Escalation

Practical tools you can apply to handovers, theatre, clinic & ward rounds

➡️ Launch offer: Enrol for £100 (usually £195) using the code:

EARLYBIRDHF

Code expires tomorrow

Secure your place now and start improving safety, performance and confidence in your day-to-day practice.

Does the NHS Benefit When Patients Go Private?

Examining the downsides and benefits of patients choosing private care

“I may go private to expedite care, but what’s the issue? I take pressure off the NHS!”

An all-too-familiar claim and one that, on the surface, sounds fairly intuitive, but does it stand up to a bit of further digging?

Where Do the Staff Go?

Practically all private hospitals employ doctors and surgeons who also work in the NHS. It has been argued, therefore, by publications such as The Lowdown, that an increase in private sector activity reduces staff availability in the NHS.

They go on to make the moral argument that these individuals have had their training subsidised and organised within the NHS, with the private sector contributing nothing to that training, merely mopping up talent once doctors reach a senior level.

There is certainly some merit to this argument. It is, of course, true that most doctors who work privately also have an NHS practice, but the claim assumes a strict trade-off: that every extra private patient reduces NHS capacity. This seems a little far-fetched and overstated. In reality, consultants and senior registrars offering private services most commonly do so outside of their contracted NHS hours.

Perhaps if the private sector ceased to exist, these senior doctors would supplement their income through additional NHS shifts at enhanced rates. However, at the moment, there is no evidence to suggest that private patients reduce the number of working NHS consultants during the week.

Changes to Funding

Tony Blair’s New Labour revolution changed the workings of Britain in many ways, and one of those changes included NHS funding. Introduced in 2003/04, Payment by Results (PbR) reimbursed hospitals based on the number and type of treatments they delivered. Each procedure was assigned a national tariff, which was intended to reflect the average cost of providing the service across the NHS.

It was never intended as profit, nor as a “bonus”, but simply to recover the costs associated with that procedure. One may argue that if a hospital treats fewer patients (because they are being seen in their nearest Nuffield), then the NHS hospital receives fewer tariff payments, but don’t forget, the trust will also incur fewer variable costs associated with that procedure (staff time, bed occupancy, equipment used, etc.).

You would therefore imagine that the net financial effect should be broadly neutral, as the hospital loses income but avoids equivalent expenditure.

Undermining NHS Training

The NHS is where doctors and nurses learn to do their jobs. Very little educational teaching happens in the private sector. Royal Colleges have raised the concern that a shift in substantial elective activity to private hospitals would ensure that trainees lose some training opportunities.

Currently, 10% of all elective work is carried out by the private sector. At the moment, this may not be significant enough to cause a nationwide training crisis, but if that percentage continues to grow, then the effects may become systemically damaging.

It seems that going private can divert staff, and there is certainly a political argument to be made about its potential to create a two-tier system. However, the claim that it necessarily hampers the NHS is more questionable. The private sector has the ability to expand overall system capacity if managed properly, as the incentive of enhanced rates in the private sector encourages senior doctors to work outside their usual contracted hours.

A round-up of what’s on doctors minds

“Was once told that the better you become at a job, the more you will begin to enjoy it. Autonomy and freedom come with mastery in a profession".

“I am curious to know how many patients one is expected to encounter on a medical take. My bosses tell me that in their day, it would be around 10.”

“I wonder every day how technology and access to imaging/tests will impact clinical medicine. Once upon a time, a clinician had to have razor-sharp clinical skills to pick up on that subtle sign. Do doctors need to be as impressive as they used to be anymore? In some specialities, the radiology and pathology departments have become the ones who diagnose.”

“Feeling for my colleagues who applied solely to IMT for the promise of five extra points and were unsuccessful… they now have nowhere else to turn.”

“I always wondered what happens to famous people when they need Emergency Medicine care. Are arrangements made to hide them from view?”

What’s on your mind? Email us!

Some things to review when you’re off the ward…

So the entitlement to receive Local Clinical Excellence Awards (LCEAs) for UK consultants closed as of April 2024. The National Clinical Impact Award scheme, which aims to reward consultants who contribute the most to the delivery of high-quality care and improvement of NHS services, is your remaining route to add a bit extra to your salary through awards. Read the BMA’s review here about the recent change.

Two years ago, Streeting told The Guardian he would “die happy” if he had the chance to lead the Labour Party. The noise surrounding Wes’ ambition is not disappearing, with headlines continuing to surface about his wandering eye on number 10.

Weekly Poll

Overall, do you think that private healthcare benefits or detracts from the NHS? |

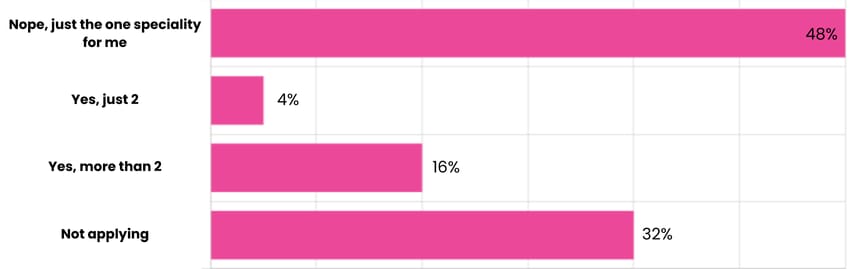

Last week’s poll:

Will you be applying to more than one speciality in this years application cycle?

…and whilst you’re here, can we please take a quick history from you?

Something you’d like to know in our next poll? Let us know!

Why Hard Work Isn’t Necessarily Enough Anymore For the UK Worker

Most of us entered medicine on a simple belief that said professional dedication and hard work would translate into long-term financial security. But economist Thomas Piketty’s R > G principle tells a different story that most workers should be familiar with. It states that returns on capital (R) (including property and investments) grow faster than the economy and far faster than wages (G).

That matters because UK doctors (and practically all workers in the UK) rely overwhelmingly on earned income, and over the past decade, real-terms pay has fallen, even as housing, childcare, and living costs have surged. We desperately hope that earned income keeps up, keeping a close eye on graphs, as our pay fails to keep up with inflation. While we work harder, the value of our labour simply doesn’t compound the way assets do.

Meanwhile, those with access to capital, especially if that help came at an early age (e.g. help with a house deposit, inherited property, or the ability to invest young through a junior ISA or trust fund), see their wealth accelerate quietly in the background.

This dynamic explains why even high-earning professionals can feel financially stretched. Those who ‘win’ in this economy are not necessarily the ones who have worked hard and moved up the career ladder; They tend to be the ones who engage early with investing, asset-building, and strategic financial planning. It’s the only way to keep pace with a system where capital outruns salary, no matter how hard you work.

Help us build a community for doctors like you.

Subscribe & Share On-Call News with a friend or colleague!

Reply