- On-Call News

- Posts

- BMA’s 52.5% Turnout Puts Strike Leverage Back on the Table

BMA’s 52.5% Turnout Puts Strike Leverage Back on the Table

The ballot survived the “silent veto” — next time, it won’t have to...

Contents (reading time: 7 minutes)

BMA’s 52.5% Turnout Puts Strike Leverage Back on the Table

Weekly Prescription

What Are You (Actually) Entitled To As A Migrant Using the NHS?

Board Round

Referrals

Weekly Poll

Stat Note

BMA’s 52.5% Turnout Puts Strike Leverage Back on the Table

The ballot survived the “silent veto” — next time, it won’t have to…

BMA HQ can finally exhale! We have spoken about the panic at BMA HQ for several weeks now over the upcoming vote to extend the industrial action mandate.

The headline that all of our community will be well aware of by now is that the BMA has scraped over the legal line of 50% turnout in the ballot, with 52.5% of eligible voters (defined by active BMA members) voting in the ballot. The turnout is the lowest achieved by the BMA since the beginning of the 2023 dispute.

In 2023, voter turnout sat at 78%, falling to 55% last July and only 52.5% this February. Fear of a protest “abstention” following the disenfranchisement of some IMGs (International Medical Graduates), following the UK graduate prioritisation (UKGP) push, was not enough to prevent the ballot from passing.

Ironically, the BMA owes a debt of gratitude to the 1,885 “No” voters. Without them, the turnout wouldn’t have reached the 50% threshold, rendering the “Yes” votes as worthless.

None of this has to mean more strikes, in the words of the BMA chair Dr Jack Fletcher, but the threat of strikes seriously increases the leverage of the union. From the government’s point of view, they may choose to look at that 52.5% and see further evidence of voter fatigue. They know that while the core base is still furious, nearly half the eligible workforce didn't even open the envelope. The number of those not casting a vote becomes even larger when you consider that the turnout figures only factor in eligible BMA voters, and a sizeable contingent of the resident doctor population will not be active BMA members and will therefore not be included in turnout figures.

Employment Rights Act

The Employment Rights Act, which received Royal Assent in December, is a complete game-changer for all unions. Once changes take effect, the 50% turnout requirement will be scrapped in favour of a simple majority, the mandate period will be extended from six months to 12 months, and electronic voting will replace postal voting. There is no doubt these changes will help the unions to enact changes, mainly through the removal of the “silent veto” of the disengaged who did not turn up to vote.

Critics will argue that this makes the option of industrial action “too easy” to enact, risking widespread instability where highly motivated groups can paralyse a hospital. Whilst we agree that industrial action should be a last resort, setting up a ballot and engaging members shouldn’t be a logistical nightmare either.

So the 52.5% turnout was the last hurdle of what can be called the “Friction Era” for the BMA. Very soon, we enter a frictionless era of easier mandates. Now the question for the union will be whether they choose to hold off until Streeting’s UKGP is turned into law, or whether they threaten strike action beforehand.

Confrontation With Colleagues: The Price of a Burned Bridge

It is almost unheard of to endure a full NHS career without the experience of confrontation with colleagues. Outbursts of emotion follow us through the profession, fuelled by the environmental stressors that the NHS so often brings. Most of the time, our thoughts remain internalised, recognising the cost of damage control after a confrontation.

“Just let it go this time,” we tell ourselves, as we muster the nearest diplomatic response we can find. Why do we do this? Some doctors, if really pushed, will admit that they are doing it to save their own ‘personal brand’. Doctors can be viewed through the lens of this personal brand. We use our personal brands as a form of currency when it comes to favours from colleagues on the ward or acquiring that weekend swap from the rota team.

In reality, many doctors avoid confrontation because they know their NHS trust is really a “small village,” and in between those ward-round cases, medication rounds, and lunch breaks, word travels very quickly. For some, the ‘reputational tax’ that follows from an upset colleague isn’t worth voicing their opinion.

You may hear some making the argument that at least this ‘reputational tax’ gives us reason to deliberate and keep our opinions in check before voicing them, but it is regrettable how our culture so often leads to a performative silence. The truth does come with its risks, but we respect it because we recognise its pursuit is worth having.

Specialty Training Mock Interviews

Expert help from top performers

Give yourself the best chance of success with expert Courses and Mock Interviews, all delivered by previous top-performers who’ve aced their applications and interviews.

More than just practice scenarios, learn the frameworks that will allow you to maximise your performance and get the job you want.

CT/ST1 | ST3/4 |

Looking for Professional Development Courses?

Expert delivered training, on-demand, virtual classroom or in-person.

What Are You (Actually) Entitled To As A Migrant Using the NHS?

Beyond the headlines, what are overseas patients entitled to?

Medical school taught us to treat the patient in front of us based on clinical need. However, as much as we strive towards this ideal, we cannot ignore the headlines. The political climate has placed us at the centre of a “health tourism” debate that suggests the NHS is a wide-open door, with some even rebranding it the “International Health Service.”

Amidst this rhetoric, it is vital to establish the true facts. Here is an On-Call attempt at doing just that:

The “Open Door” of Primary Care

A common misconception is that one needs a passport or proof of address to register with a GP. This is legally and contractually incorrect. Anyone in England can register with a GP and consult said GP for free; immigration status is irrelevant at the point of registration.

The logic is that primary care acts as the frontline of public health. By barring undocumented migrants from GPs, we lose the ability to manage communicable diseases and immunisations. This eventually costs the taxpayer more down the line if those patients require crisis-level secondary care.

The law also acknowledges services that are too critical for the public good to be placed behind a paywall. These include A&E services (up until the point of admission), treatment for communicable diseases (such as TB and HIV), vulnerability exemptions (treatment for conditions caused by torture, FGM, or sexual violence), and compulsory care, such as for patients detained under the Mental Health Act.

The Hospital Filter

While the above services are free, secondary care in hospitals is a “residence-based” system. To receive free secondary care, a patient from outside the EEA (the EU countries plus others such as Norway, Iceland, and Liechtenstein) must generally have Indefinite Leave to Remain.

If a patient is not exempt (for example, if they are on a six-month visitor visa), they will be charged at 150% of the standard NHS tariff. Regardless of one's political stance, this serves as an economic deterrent intended to prevent individuals from using the NHS specifically for "health tourism" while the system is already buckling under current demand.

For those coming to the UK for more than six months, an Immigration Health Surcharge (IHS) is applied at the time of the visa application to ensure they contribute to the financial sustainability of the NHS. As of 2025/26, the cost of this IHS is £1,035 per year for most applications and £776 for student Visas. So, someone applying for a five-year student visa must pay £3,880 before they even set foot in the UK. Once paid, a migrant can use the NHS in the same way as a British citizen, free at the point of use.

For years, migrant doctors were required to pay these IHS fees in addition to Income Tax and National Insurance once they began working. This "double tax" left many doctors disgruntled. However, the COVID-19 pandemic led to a massive public outcry and the subsequent introduction of the Health and Care Worker Visa. This removed the IHS burden for medical staff, meaning migrant doctors on this visa are now exempt.

While the original logic for the payment was that migrants had not contributed to the "taxation pot" for as long as UK citizens, the pandemic effectively flipped those rules for the healthcare workforce.

The Urgent Ethical Tightrope

Here is the are of contention that presents the most difficult logical hurdle for doctors. If the treatment is deemed to be non-urgent until the patient returns home, the NHS trust must secure payment in full before the treatment begins. The decision on what treatments are urgent and non-urgent ultimately lies with the clinician. This creates huge grey zones where, say, if you have a patient who is an asylum seeker with a pending appeal, they may be in the UK for years.

In this case, “urgent” care can technically include elective procedures such as a hip replacement or cataract surgery because it is unreasonable to expect them to live with hip pain for three years. In reality, therefore, many fall into the urgent category given the length of time it takes to process appeals.

A round-up of what’s on doctors minds

“10:30 pm, patient is explaining to me why she is opposed to having a mammogram, as the squashing of her breast tissue will give her breast cancer. Not quite sure about that logic, after all, I am sure she is not too concerned about cancer of the behind from sitting down all day. Ladies and gentlemen, I present to you another case of Brandolini’s Law.”

“Having to explain to a patient’s family why a brain transplant is not possible was not on top of my ITU bingo card list this morning.”

“Waiting for this MSRA is a different type of anticipation. A truly bizarre exam where one has absolutely no idea if they have done enough to get over the line.”

“Is there anything more valuable in a relationship than a person who understands the stresses and expectations of the job?”

What’s on your mind? Email us!

Some things to review when you’re off the ward…

Australia, Australia, Australia. We have become accustomed to hearing the name of our cousins living down under, especially when medical training application season comes around. But what if we had numbers to suggest that an increasing proportion of doctors may be choosing to stay in the UK? Here’s the full article from the BMJ.

Three-quarters of patients will survive cancer for at least five years by 2035 - At least that’s the promise by the government, and they look to revamp cancer care in the UK, as five-year survival currently sits at 60%. Here is how they are planning to achieve it.

Weekly Poll

Which of the following best describes your philosophy as a doctor? |

Last week’s poll:

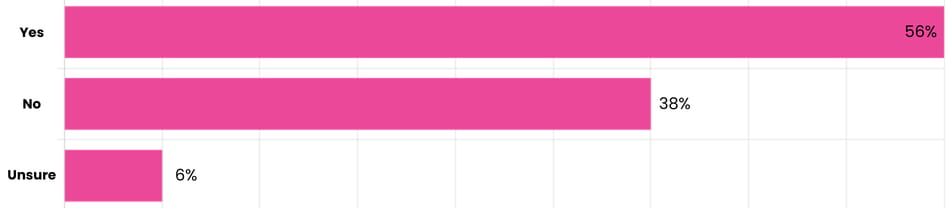

Do you think capping ADHD assessment funding is fair?

…and whilst you’re here, can we please take a quick history from you?

Something you’d like to know in our next poll? Let us know!

April 5th is Approaching, Claim What You Are Owed!

As a new tax year edges closer, many of our On-Call community will need a reminder that tax rebates are waiting at HMRC for you to claim them. If you think that HMRC will send you a nice reminder to claim what you are owed, then you are sadly mistaken.

So when you claim an expense such as a £400 GMC fee, that amount is deducted from your taxable income. If you pay the higher rate of income tax at 40%, for example, you get the tax you paid on that £400 back (£160). Once these expenses are claimed, HMRC often adjusts your tax code, meaning you will pay less tax in your monthly paycheck going forward, effectively giving you a ‘rebate’ in instalments.

Claims can be put in for exam fees, including travel to those exams, CCT fees, GMC/Royal College memberships, professional indemnity costs (MDU/MPS) and any other training costs. You can claim a tax rebate for the four previous tax years, and the process is much easier than you would believe, as long as you keep receipts.

Now, HMRC is not going to part with its money easily; there are some things that are not tax-deductible. This includes any costs that your employer has already covered and are therefore not an expense to you. Revision courses for exams also fall into this group.

We think the guys over at Medicsmoney have created the best step-by-step guide on how to start this process. Find the guide here.

Help us build a community for doctors like you.

Subscribe & Share On-Call News with a friend or colleague!

Reply